How to File GSTR 3B Using Offline Utility: Step-by-Step Guide

- 15 Sep 25

- 7 mins

How to File GSTR 3B Using Offline Utility: Step-by-Step Guide

Key Takeaways

- GSTR-3B is a mandatory GST return that taxpayers must file monthly, summarising outward and inward supplies along with tax liability.

- The GSTR-3B offline utility allows taxpayers to prepare returns easily in Excel and generate a JSON file for upload on the GST portal.

- Using the offline tool ensures error-free return filing, as the sheet validates entries before generating the JSON file.

- Timely filing of GSTR-3B avoids penalties, late fees, and 18% p.a. interest on unpaid tax dues.

- Uploading the GSTR-3B JSON file on the GST portal simplifies compliance, ensuring smooth vendor management and GST compliance in India.

Filing GSTR-3B is a mandatory compliance requirement under India’s Goods and Services Tax (GST) regime. This monthly return summarises a taxpayer’s outward and inward supplies, along with the tax liabilities and payments for the period. While the online portal is commonly used, the offline utility offers a convenient alternative, especially in areas with poor internet connectivity or for bulk data entry.

This guide walks you through the step-by-step process of filing GSTR-3B using the offline utility, ensuring accuracy and ease. Whether you’re a seasoned filer or new to GST, this method can simplify your return filing experience.

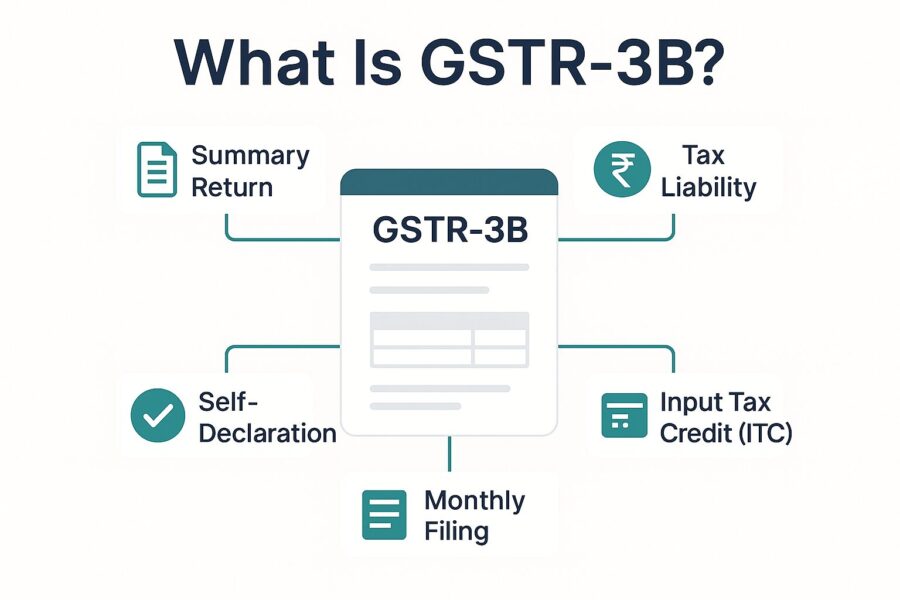

What Is GSTR-3B?

Form GSTR-3B summarises the net GST liability paid and declared in GST return filing. Registered persons, such as casual taxpayers, who need to file returns in Form GSTR-1, need to file Form GSTR-3B return. This is a monthly returns form that taxpayers need to file for their tax liability.

In other words, this is called the monthly return GSTR-3B form. It is a mandatory return that taxpayers have to file. However, it excludes the following list of persons:

● Input Service Distributor (ISD)

● Composition Dealer or Composition Taxpayers

● Non-resident Taxable Person

● Supplier of Online Information Database Access and Retrieval Services (OIDAR)

● A person authorised to deduct tax under Section 51 and collect tax under Section 52

Notably, you can file this return online. Nevertheless, the offline tool helps prepare a JSON file and the necessary data that you need to upload to the GST portal.

Process to Download and Open the GSTR-3B Offline Tool

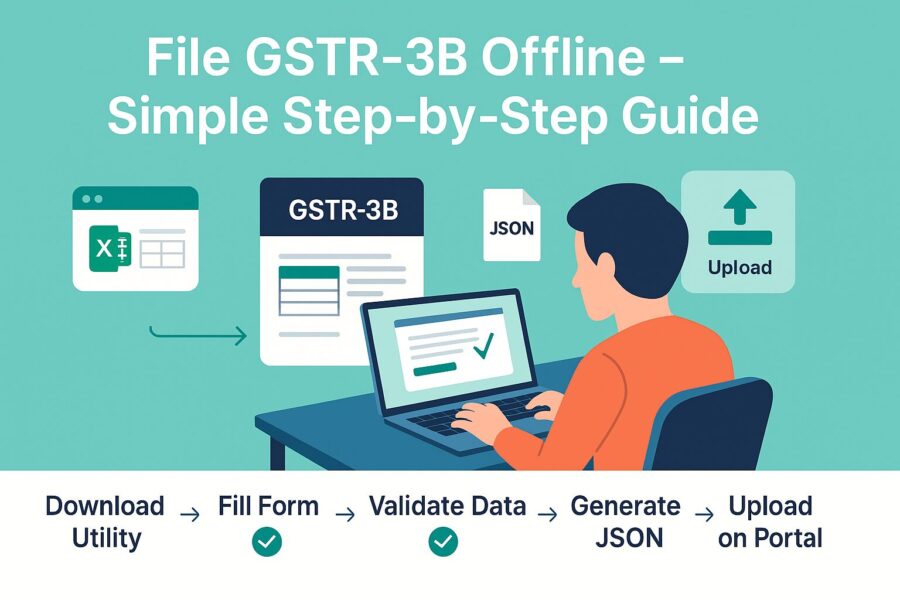

You can follow the simple steps mentioned below to download and open the offline tool for GSTR-3B:

Step 1: Visit the unified GST portal.

Step 2: Go to ‘Downloads’, then ‘Offline Tools’ and ‘GSTR-3B Offline Utility’.

Step 3: Select ‘Download’ before you click on ‘Proceed’.

Step 4: Extract the zip file that you downloaded.

Step 5: Go to the location of the extracted files and open it in Excel.

Process to Prepare GSTR-3B Using Offline Tool

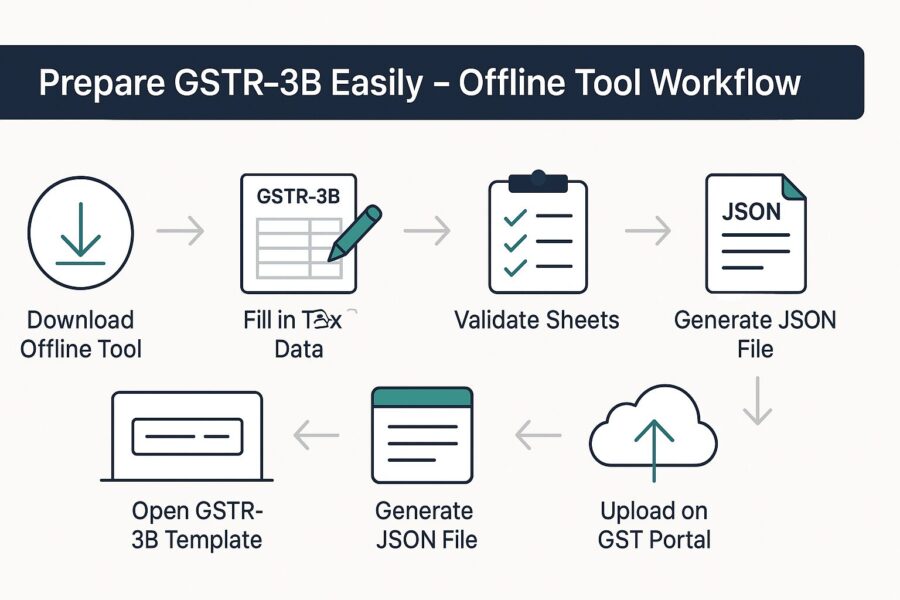

Here are the steps to prepare GSTR-3B using the offline tool:

Step 1: Select ‘Enable Editing’ and ‘Enable Content’. You can click on ‘Clear All’ to ensure your utility is blank before you fill in the details.

Step 2: Go to the GSTR-3B worksheet to fill in the tables with data.

Step 3: Fill in the details of the taxpayer such as GSTIN, financial year, registered person’s legal name and the month (tax period).

Step 4: In the tables, you need to fill in data such as outward supplies and inward supplies liable under the reverse charge mechanism (Table 3.1), details of inter-state supplies to unregistered persons, UIN holders and composition taxable persons (Table 3.2), eligible input tax credit (Table 4), values of exempt, non-GST inward supplies and nil-rated supplies (Table 5), interest and late fees (Table 5.1).

Step 5: Select ‘Validate’ to proceed. You will see a pop-up message ‘Sheet Validated. Please Proceed to Generate JSON File’. The sheet status will display ‘Validation Successful’ on successful validation of data. If there is a discrepancy or unsuccessful validation, you will see ‘Validation Failed’. Check for the relevant error message and rectify the same to proceed. You can check the errors in the comment section by clicking ‘Show All Comments’. Once you complete it, click on ‘Validate Sheet’ to proceed.

Step 6: Once you see the ‘Validation Successful’ pop-up message, click on ‘Generate File’. Once the JSON file is created, click on ‘Ok’ once you see the confirmation message.

Step 7: Your JSON folder will be created in the name ‘GSTR’. Look for the JSON file inside the folder.

Process to Upload Generated JSON file for Form GSTR-3B

Here is the process to upload a generated JSON file for GSTR-3B:

Step 1: Visit and log in to the official GST portal using valid credentials.

Step 2: Go to the ‘Services’ option and then ‘Returns’, ‘Return Dashboard’.

Step 3: Before you click on ‘Search’, select the return filing period and the financial year from the drop-down list.

Step 4: Click on ‘Prepare Offline’ on the GSTR-3B tile.

Step 5: Click on ‘Choose File, and then ‘Open’ on the selected JSON file. Your JSON file will be uploaded and the screen will display a success message.

Step 6: Go back to the ‘Return Dashboard’ and click ‘Prepare Online’ to check the uploaded details.

Step 7: If all the details are accurate, click on ‘Submit’.

Conclusion

To answer how to file GSTR-3B using the offline utility it needs to be mentioned that you need to follow the steps accurately to avoid errors. Timely filing of GSTR-3B helps you avoid penalties, late fees and interest, thereby ensuring a smooth cash flow in the business.

You can further ensure effective vendor payment, vendor management and vendor delight with timely return filing of GSTR-3B. Ensure you comply with the stipulated timeline and Indian tax laws for a complete supply chain solution.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.